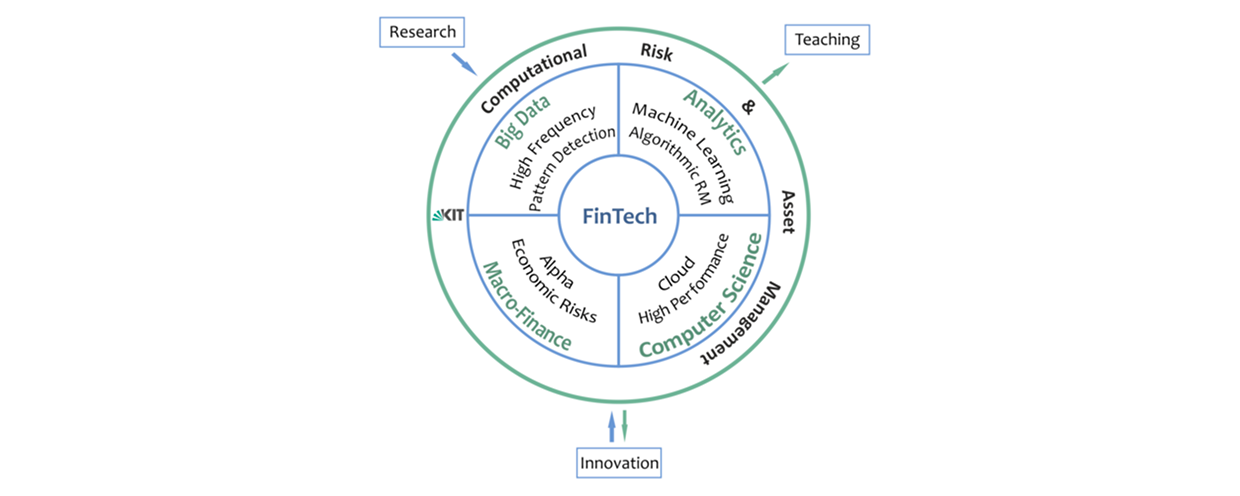

Computational Risk and Asset Management Research Group (C-RAM)

Mission

The computational risk and asset management research group at the KIT focuses on developing risk management 4.0 solutions. Our research tries to understand how economic and financial risks affect financial markets and provides solutions and know-how to the research community, private and public decision makers, on how to extract relevant information from high-frequency financial data and how to protect from adverse economic and financial market shocks. Better information leads to improved automatic risk management and has the potential to generate sustainable alpha strategies for investors. As our teaching relies on the superb quantitative and information technology education of our esteemed colleagues at the Industrial-Engineering & Management department of the KIT, we tilt our own research-oriented risk management education towards modern financial software and data engineering.

Our risk management philosophy for research, teaching and innovation relies on four focus areas. First, in order to measure and quantify financial market risks in real-time, we allocate a considerable amount of resources towards high-frequency pattern detection in publicly traded financial assets. Second, in order to analyse large amounts of financial data efficiently, a second strand of our resources is devoted towards the development of predictive analytics tools. Right now, we analyse the applicability of machine learning for algorithmic risk and asset management. Third, novel predictive analytics and big data tools require a smart IT infrastructure. We therefore incorporate cloud and high performance IT designs into our risk management 4.0 solutions. Last but not least, combining all of the previous three focus areas with our main research area, macro-finance, puts us in a position to analyze the interplay of economic and financial risks at a higher frequency and with modern predictive analytics tools.