KABFI — PhD Program 🎓

PhD Research Training Group on Artificial Intelligence for Business & Financial Market Investigations

KABFI (pronounced “cab‑fee”): KIT’s AI, Business, and Financial Markets Insights Ph.D. Research Training Group.🔔 NEWS Alert!

New PhD Research Internship Opportunity

KABFI, together with Deutsche Börse and Allianz Global Investors, has launched a research-oriented PhD internship program.

The internship lasts 4–6 months (within each 12-month period) and can start from the second year of the PhD, after completion of at least one PhD research paper at KIT. The goal is to complete a PhD research paper jointly with the industry partner.

What We Are

We are an interdisciplinary, international PhD community that turns complex, messy data into actionable insight for business and financial markets. Our training combines machine learning, modern econometrics, and economic reasoning to reduce uncertainty and support better decisions in complex systems.

Why KABFI⭐

-

Data‑driven & rigorous: Machine learning + econometrics + economic intuition.

-

Markets focus: Strong roots in financial and option markets; methods generalize across industries.

-

Mentoring culture: Faculty and senior PhDs co‑advise; publication‑oriented projects.

-

️Real infrastructure: HPC clusters, broad financial databases, and proprietary tick‑by‑tick option analytics plus full order‑book data (Xetra, Eurex, EEX) via Deutsche Börse Group.

-

Global community: Researchers from Vietnam, Iran, China, the USA, Germany, Bulgaria, Singapore, Latin America and beyond; many combine research with roles at KIT, international institutions, or industry.

Program at a Glance

-

Academic aim: Joint, high‑impact publications in AI finance, Financial Machine Learning and statistical modeling prior work has been published in The Review of Financial Studies, The Review of Derivatives Research).

-

Financials: Tuition‑free PhD. Students cover living expenses; we help secure scholarships and part‑time roles (KIT/industry) and PhD research internships.

-

Access & flexibility: Campus presence in Karlsruhe is strongly encouraged; hybrid options are possible for outstanding candidates and joint‑supervision settings.

-

Collaboration: Active ties in Germany and abroad; complementary tracks with KIT programs like the Graduate School Computational and Data Science (KCDS).

Admissions & Fast‑Track Options

We welcome strong applications year-round from quantitative candidates in finance/economics, CS, engineering, data science, etc.

Apply: Submit CV, motivation letter, and transcripts to ✉️kabfi∂fbv.kit.edu.

-

Standard entry: Master’s in a relevant field with strong grades (typically good (B) to very good (A)).

Fast-Track pathways for exceptional students:

-

Direct Bachelor’s Entry: Top 5% (95th percentile) Bachelor graduates may enter directly; PhD thesis can often be submitted shortly after peers complete a Master’s. (All formal Promotionsordnung requirements apply.)

-

Integrated Fast Track (KIT): Complete KABFI core PhD coursework during the KIT MSc; if BSc/MSc theses are conducted with KABFI, PhD submission is typically possible within ~18 months of MSc graduation.

-

Emerging Partner Route: With CS departments at other German universities, selected Bachelor students may combine KABFI doctoral training with graduate-level CS coursework under applicable PhD regulations.

For details on the partner route or your fit, contact ✉️kabfi∂fbv.kit.edu.

PhD Internship Program

KABFI offers a new industry internship option for advanced PhD students in cooperation with Deutsche Börse and Allianz Global Investors.

-

Target Group: KABFI PhD students who have completed at least one research paper during their doctoral training at KABFI.

-

Objective: Internships are designed to support students in advancing PhD research with an industry focus, culminating in a research paper jointly developed with the host organisation.

-

Duration: 4–6 months per placement, to be undertaken within any 12-month period.

-

Placements: Multiple internship positions may be available over the course of the KABFI training period; students may engage in more than one placement, subject to approval.

-

Collaboration Structure: Each internship will pair a PhD candidate with mentors from both the industry partner and the KABFI research environment to ensure academic rigour and practical relevance.

This initiative complements the KABFI training concept by strengthening the link between academic research and applied financial market analysis.

️ Coursework & Training (Portfolio)

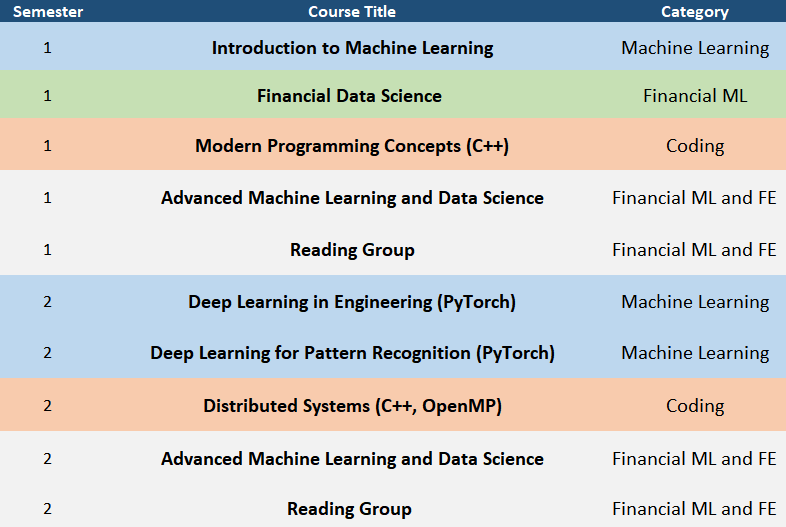

The KABFI PhD Course Portfolio is a full-time, two-semester training plan that builds rigorous foundations in machine learning, deep learning, financial data science, and modern software systems. All courses are mandatory and open to KABFI PhD students. Financial Data Science may admit non-KABFI students (subject to prerequisites and space).

Format & workload

-

Two consecutive semesters

-

~6 substantial problem sets per course

-

Weekly Reading / Discussion Groups on AI and ML

Learning Outcomes

-

A superb understanding of the basics and current advances in ML

-

Special focus on high dimensional sequential data

-

Sound software engineering experience (tests, version control, containers, reproducibility, algorithmic engineering)

-

Financial applications (Explainable AI, high-frequency, stocks and option markets)

-

Expert knowledge in unsupervised, supervised and reinforcement learning

-

Communication: clear writing, clean code, replicable results

Academic integrity & collaboration

-

Submit your own work; free discussion with classmates is encouraged.

-

LLMs allowed for ideas/code review—add a short usage note.

-

No plagiarism; uncredited AI/copied code is prohibited.

-

Individual research work is integrated into larger themes and topics.

-

Research collaboration across different groups of PhD students and faculty

Suggested Two-Semester Path

AI & Machine Learning

-

Introduction to Machine Learning (Python): End-to-end ML workflow covering supervised and unsupervised learning with data preprocessing, metrics, and rigorous model selection; core methods (linear models, SVMs, decision trees, Bayesian learning, neural networks/deep learning), ensembles and meta-learning, and an introduction to reinforcement learning, Assessment: 6 problem sets with unit tests + short write-ups.

-

Deep Learning in Engineering (PyTorch): PyTorch-based course that builds practical expertise in modern deep learning for engineering. Topics include MLP/CNN/RNN architectures, optimization and regularization, experiment tracking, and rigorous, reproducible evaluation. Students implement end-to-end models on real data and learn best practices for reliable results in research and production. Assessment: 6 problem sets + mini-project(with reproducible code and report).

-

Deep Learning for Pattern Recognition (PyTorch): Current trends and innovations in pattern recognition. Assessment: 6 problem sets + reports.

Financial Machine Learning

-

Financial Data Science (Python) (open to non-KABFI, space permitting): A rigorous, practice-driven survey of contemporary financial data science that integrates asset-pricing intuition with econometrics and machine learning. The course develops end-to-end capability for research-grade portfolio analysis, including event alignment, factor construction, option-implied risk (RNDs), market microstructure, robust backtesting, and ML methods for return prediction and portfolio design. All workflows are implemented in Python with a strong emphasis on experimental design, reproducibility, and clear, decision-oriented communication of results. Assessment: 6 problem sets + reports.

-

Advanced Machine Learning and Data Science: A concise, project-based immersion in state-of-the-art machine learning, data science, deep learning, and reinforcement learning in finance. Students tackle real-world datasets, implement modern methods, and practice rigorous experimentation, reproducibility, and critical evaluation. Assessment: Capstone project using real-world data + reproducible code and report.

-

Reading / Discussion Group: Financial ML & Financial Economics: Weekly papers, short presentations, replication sketches. Assessment: short synthesis notes (no problem sets).

Coding & Systems

-

Modern Programming Concepts (C++): Intensive C++17/20 practice: RAII, copy/move semantics, smart pointers, templates & STL, const-correctness, and profiling, using professional tooling (git, CMake) and unit testing/TDD with gtest. Assessment: 6 problem sets with performance/robustness checks.

-

Computing Distributed Systems (C, C++): Introduction in Parallelization of code. Assessment: 6 problem sets with performance/robustness checks.

Suggested Two‑Semester Path 🧭

Semester 1

-

Introduction to Machine Learning

-

Financial Data Science (open to non-KABFI)

-

Modern Programming Concepts (C++)

-

Advanced Machine Learning and Data Science

-

Reading Group ✍️

Semester 2

-

Deep Learning in Engineering (PyTorch) ️

-

Deep Learning for Pattern Recognition (PyTorch)

-

Computing Distributed Systems (C++) ️

-

Advanced Machine Learning and Data Science

-

Reading Group (align topics with your thesis) ✍️

Tools & Setup ⚙️

-

Languages: Python (main), C++ (systems)

-

Libraries: pandas, numpy, scikit-learn, statsmodels, matplotlib, torch, transformers

-

Engineering: Git, Docker/containers, experiment tracking (e.g., W&B, MLflow)

-

Auto-grading: Some tasks provide local tests—run before submitting.

️ Research & Facilities

-

️ Infrastructure: State-of-the-art HPC; U.S. & European market data; proprietary tick-by-tick option analytics; full order-book data (Xetra, Eurex, EEX) provided by Deutsche Börse Group.

-

Support: Senior PhDs provide hands-on onboarding, coaching, and project guidance.

-

Topics: Financial economics & engineering; computational risk & asset management; ML for capital-market analytics; supervised learning for business problems; financial reinforcement learning; algorithmic finance.

-

Cross-disciplinary supervision: Joint projects with CS departments expand topic breadth (ML, data science, algorithmic finance).

Careers & Alumni Outcomes

Graduates secure competitive roles in quantitative finance, asset & risk management, consulting, and AI-driven entrepreneurship—often prior to dissertation completion. Recent placements include Barclays (London) and Morgan Stanley (New York), reflecting KABFI’s emphasis on rigorous analytical training, economic intuition, and whiteboard-level problem solving.

“The interviews were like your lecture notes… What impressed the interviewers most was not just the technical depth, but the ability to connect the maths with economic thinking and intuition.”

“I would love to pursue a PhD, but for now I need to focus on learning my new job. I’m not ruling out returning to discuss a PhD in the future.”

The program supports a range of trajectories. Whether immediately after a bachelor’s or master’s degree or following industry experience, students receive mentoring and guidance to develop a pathway toward advanced academic inquiry and long-term research.

Corporate Collaboration🤝

Current acknowledgments

-

Landesbank Baden-Württemberg (LBBW): Financial support for doctoral scholarships.

-

Deutsche Börse Group: Historical and real-time order-book data (Xetra, Eurex, EEX)—critical infrastructure for advanced research in capital markets and financial data science.

-

Deutsche Börse Group & Allianz Global Investors: PhD Research Internship Program

KABFI offers companies a unique opportunity to engage with a research environment that combines academic rigour, data-intensive methods, and direct relevance to business challenges. Our interdisciplinary work at the intersection of finance, AI, and data science delivers insights for both applied and theoretical questions. Alumni regularly attract competitive offers from global hubs such as New York, London, and Zurich—another reason for local and national partners to engage early.

Engagement Options

-

Sponsor scholarships

Enable outstanding candidates to pursue doctoral research aligned with evolving business needs. We provide regular updates and exchange to keep projects relevant. -

Develop in-house talent

Support employees in pursuing a PhD within the KABFI framework—typically via a 50% employment model—combining professional practice with academically rigorous, industry-relevant research. -

Offer part-time roles

Bring KABFI PhD researchers’ data-driven perspectives into your organisation through research-oriented part-time positions.

FAQ

-

Are these courses mandatory? Yes.

-

How much time should I plan per course? Approximately 8–12 hours per week, depending on background.

-

Can I collaborate? You may discuss freely with peers, but submit your own work and disclose any LLM assistance.

-

Will this help my thesis? Yes. Methods, tools, and the Reading Group are designed to support dissertation research.

Participation & Inquiries

For participation as a KABFI PhD student, please contact:

-

Program admissions and general inquiries: ✉️ kabfi∂fbv.kit.edu

-

Course portfolio inquiries:✉️ maxim.ulrich∂kit.edu